Tax Return Gambling Winnings

So you’ve managed to beat the oddsmakers at a Tennessee sportsbook? Or perhaps you’ve hit it big playing Mega Millions, Powerball or another Tennessee Lottery game?

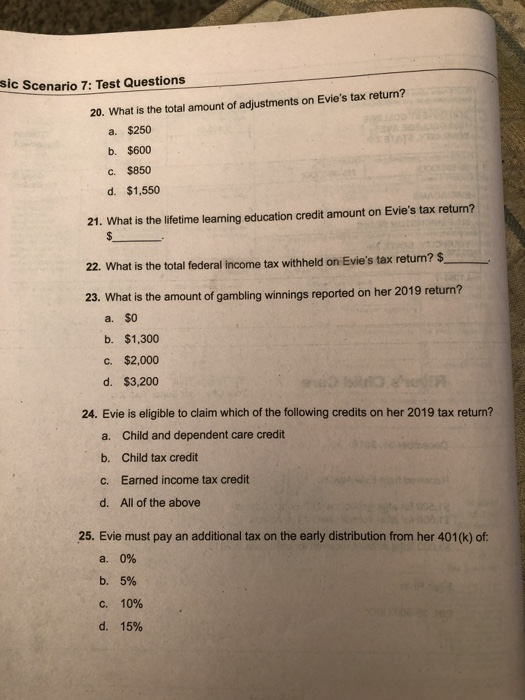

If your winnings are reported on a Form W-2G, federal taxes are withheld at a flat rate of 24%. If you didn’t give the payer your tax ID number, the withholding rate is also 24%. Withholding is required when the winnings, minus the bet, are: More than $5,000 from sweepstakes, wagering pools, lotteries.

You have to report your winnings and file a tax return for the year funds were received. Meaning, if you won in 2019 then you need to file a 2019 tax return. Also, you can only claim your gambling losses if you are able to itemize your tax deductions. You have to report your winnings and file a tax return for the year funds were received. Meaning, if you won in 2019 then you need to file a 2019 tax return. Also, you can only claim your gambling losses if you are able to itemize your tax deductions. You must file Form IT-540B, Nonresident and Part-year Resident Return, to report your winnings and withholdings to Louisiana. To obtain a copy of the return, visit LDR’s Forms page or call (888) 829-3071 and select option 6.

Not to rain on your parade, but the IRS considers any gambling winnings taxable income. This includes cash and material prizes such as boats and cars.

According to federal law, you must report your winnings on your federal tax return for the appropriate year. This is especially crucial for Tennesseans now that online sports betting is legal.

Tennesseans might have many questions related to gambling and taxes. These might include how to report your winnings to the IRS, along with what rate the IRS taxes those winnings at.

Fortunately, it isn’t that complicated. The IRS has clear procedures in place for how to handle such instances. When you know those procedures, you can rest assured that you’re compliant with federal laws.

Sportsbooks and the Tennessee lottery can help you out in this regard as well. They also have to follow federal and state reporting procedures, so their protocols can make the process of reporting winnings even easier for players.

Here are your obligations under federal and state laws if you’ve successfully gambled in Tennessee.

How much will the IRS tax my gambling winnings?

Effective for tax years after 2017, the federal withholding rate for gambling winnings of $5,000 or more is 24%. That’s a cumulative amount for the entire year, so even if you win $1,000 on five or more separate occasions during the year, you still need to report your winnings.

Sportsbooks and the Tennessee lottery typically withhold 25% of your total winnings for tax purposes. That’s only if you provide the sportsbooks with your Social Security number, however.

If you choose to withhold your SSN from sportsbooks, they typically withhold 28% of your winnings. Sportsbooks need your SSN to accurately report their business dealings to the IRS.

Tennessee has no state earned income tax. Your winnings may be subject to the Hall Income Tax, however, for the 2020 tax year and prior years.

It really depends on how you use those funds. The state doesn’t consider your lottery and sports betting winnings themselves taxable income, but if you use the money to produce certain kinds of dividends and interest, the state may tax those dividends and interest.

There are many exceptions to the taxable dividends and interest list, such as interest paid on personal savings accounts. The Hall Income Tax sunsets completely on Jan. 1, 2021.

For 2020, the rate is 1%.

The IRS has a form specific to reporting gambling winnings. That’s where the Tennessee sportsbook apps and the Tennessee lottery can be of the greatest assistance to you.

Federal form W-2G, certain gambling winnings

The IRS puts the burden of sending out the W-2G on the organization that pays out winnings. If you win any cash or prizes this year, you should get a W-2G from that entity in plenty of time to file your federal taxes.

Fortunately, there’s nothing you need to do to the form. Do not include it in your IRS filing. You will need it when you file your federal income tax return, however. You should keep a copy for your own records for at least five years.

If your winnings reach one or more of the following thresholds, you should get a W-2G from the sportsbook you won with or the Tennessee lottery. Each entity you successfully gambled with will provide you with a separate W-2G.

Those federal thresholds are:

- Winnings of $1,200 or more from a bingo game or slot machine

- Winnings, minus your wager, of $1,500 or more from a keno game

- Winnings, minus your buy-in or wager, of more than $5,000 from a poker tournament

- Winnings of $600 or of a value at least 300 times the buy-in/wager or more, except those from bingo, keno, poker tournaments and slot machines

- Winnings that are subject to federal income tax withholding for any other reason

What if I don’t receive a Form W-2G?

If you’re a legal US citizen or resident, you must report your eligible gambling winnings on your federal earned income tax returns regardless of whether you receive a Form W-2G or not.

Contact the sportsbook operator or the Tennessee lottery if you need a W-2G and don’t receive it in a timely manner, there may have been an error.

If you still can’t get a W-2G, use Form 1040, Schedule 1 to report your winnings. Use the “Other Income” section to denote the value of your cash and material prize winnings.

Include that form with your other documents in your IRS filing for the appropriate year. There’s one more step you need to take even if you do receive a Form W2-G.

How to report winnings on your federal income tax return

The IRS requires you to report your gambling winnings on Form 1040, Schedule T, Line 8. If you do get a Form W-2G, this is a very simple process.

Since you are reporting your gambling winnings from all sources, gather up all your relevant W-2G forms (if you have more than one). If all your winnings came from a single source, this process is even easier.

Simply transfer the amount in Box 1 on your W-2G form to Line 7a of your 1040. If you received more than one W-2G, you will need to add up all the amounts in Box 1 on all the forms and then put that total in Line 7a of your 1040.

The same process applies if there is an amount shown in Box 2 on your W-2G forms. Include that amount in your total federal income tax withheld on Line 17 of your 1040.

This is the correct procedure for reporting gambling winnings for an individual. If you’re part of a group that won a cash or material prize, the process is a little different.

What if I’m part of a group of people that wins a cash prize?

If you and several of your co-workers pool resources to buy lottery tickets and win, or you go in with a couple of friends on a big sports wager, the IRS still considers your winnings taxable income. There’s a form just for these occasions.

That’s Form 5754. The sportsbook and/or the lottery use this form to prepare the W-2G when a group of people wins a prize, or the person receiving gambling winnings isn’t the actual winner.

The sportsbook or the lottery should send you a blank copy. The onus is on you to accurately fill it out and return it to the party granting the prize. They need it for their tax records.

Just like the W-2G, you shouldn’t include this form in your federal tax return. You should keep it for your own records, however. The minimum recommended time to do so is five years.

Are gambling losses tax deductible?

You can deduct your gambling losses. You must itemize your deductions in order to take advantage of that allowance, however. The IRS does not allow you to deduct more than you win in a tax year or deduct your expenses incurred while gambling.

Just like with any other deductions you claim, you should keep all relevant paperwork for a period of at least five years. This includes:

- Receipts for your wagers that denote the date and type of bet

- The name of the sportsbook or the location where you bought a lottery ticket

- The amount lost or won

- Wagering tickets

- Debit card records

- Bank statements

- Canceled checks

Many sportsbooks keep a running account of your activity in your account profile. This can make it easy to identify your total losses for the year and see if it would be worthwhile to itemize your deductions and report them.

Remember, deducting your losses isn’t a matter of subtracting your losses from your winnings and then simply reporting what’s leftover. You must report all your qualified winnings to the IRS regardless of any losses you suffer.

What if I win a Mega Millions or Powerball jackpot?

The IRS considers cash or material prizes won playing multi-state lotteries as taxable income. You would report such prizes using the same methods as if you won a prize playing a Tennessee lottery game.

The same goes for if you claim winnings in Tennessee but maintain your legal residence in another state.

The process of reporting the value of non-cash prizes is somewhat murky, however.

The IRS does supply a definition of the “fair market value” of material prizes. That is, “the price for which you could sell your property to a willing buyer when neither of you has to sell or buy and both of you know all the relevant facts.”

The IRS does not supply a formula to determine that value, however. You will have to check out the going rates for similar items in your area to determine the fair market value for your material prize.

Once you’ve determined that, you need to include that with your winnings for the year on your Form 1040. If you’re unsure of how to value your prize, this is where contacting the IRS may be beneficial.

Online sports betting and taxes

The IRS makes no differentiation between winnings won in-person or online in terms of gambling. Additionally, the IRS considers sports betting winnings taxable income.

You must report all your qualified sports betting winnings, whether they came through online or retail channels, to the IRS. The general rule of thumb is to report your winnings once you hit the threshold of $600 or winnings of 300 times the amount you have wagered in a tax year.

The sportsbook should send you a Form W-2G. This will make it easy for you to report your winnings on Line 7a of your Form 1040 for the IRS.

Tennessee is among the best states for gambling purposes, as the state does not tax your winnings in most cases. Following this advice, you can fulfill your federal obligations and enjoy the remainder of your winnings.

Letting the Door Hit You in the Tax on the Way Out: IRS Issues Relief Procedures for Certain Persons Who Relinquished US Citizenship But Wish to Complete Tax Compliance

The Dual Liability Provisions for a Responsible Person under California Sales Tax Law

Can You Net Gambling Wins With Gambling Losses on Your Tax Return?

Taxpayers who gamble casually (meaning they do not qualify as being professional gamblers under the tax code) can net wins and losses within a single session of gambling, but not from different days. The total of multi-session wins would be reportable as “other income” on Form 1040 but the total of multi-session losses would be reported on Schedule A under “Other Itemized Deductions,” up to the amount of your winnings.

Because casinos report larger winnings to the IRS on Form W-2G, failing to use this method may cause the IRS to see a discrepancy and trigger an audit. The general IRS advice on this topic can be found on the IRS’s website (click here).

The netting ofwins and losses is addressed by the Tax Court in Shollenberger v.Commissioner, T.C. Memo. 2009-306 (2009), where the court followed IRSguidance in stating:

A key question in interpreting §165(d) is the significance of the term “transactions.” The statute refers to gains and losses in terms of wagering transactions. Some would contend that transaction means every single play in a game of chance or every wager made. Under that reading, a taxpayer would have to calculate the gain or loss on every transaction separately and treat every play or wager as a taxable event. The gambler would also have to trace and recompute the basis through all transactions to calculate the result of each play or wager. Courts considering that reading have found it unduly burdensome and unreasonable. See Green v. Commissioner, 66 T.C. 538 (1976); Szkirscak [sic] v. Commissioner, T.C. Memo. 1980-129. Moreover, the statute uses the plural term “transactions” implying that gain or loss may be calculated over a series of separate plays or wagers.

The better view is that a casual gambler, such as the taxpayer who plays the slot machines, recognizes a wagering gain or loss at the time she redeems her tokens. We think that the fluctuating wins and losses left in play are not accessions to wealth until the taxpayer redeems her tokens and can definitively calculate the amount above or below basis (the wager) realized. See Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955). For example, a casual gambler who enters a casino with $100 and redeems his or her tokens for $300 after playing the slot machines has a wagering gain of $200 ($300-$100). This is true even though the taxpayer may have had $1,000 in winning spins and $700 in losing spins during the course of play. Likewise, a casual gambler who enters a casino with $100 and loses the entire amount after playing the slot machines has a wagering loss of $100, even though the casual gambler may have had winning spins of $1,000 and losing spins of $1,100 during the course of play. [Fn. ref. omitted.]

W-2g Gambling Winnings

Thus, the net win from the session as a whole (e.g., when the taxpayer actually cashes out for the day) would be reported under “other income” while the net loss from another day’s session would belong on Schedule A.

Fortunately, those who use casinos’ player cards often can get a statement from the casino breaking down daily wins and daily losses. Some casinos, however, decline to provide this level of detail to their own customers despite having such records. Instead, those casinos will provide only an annual net win or loss statement. As this may cause problems in an IRS audit if the auditor is a stickler for technicalities, a taxpayer may prefer to patronize casinos which provide the additional detail as a higher-level of customer service.

The author of this post is Daniel W. Layton, a former IRS trial attorney and ex-federal prosecutor in the Tax Division of the Los Angeles U.S. Attorney’s Office. He is a tax attorney representing private clients in Newport Beach and Fullerton, Orange County, California.

Tax Return Gambling Winnings Real Money

Posted on 12/11/2019 by Daniel Layton.